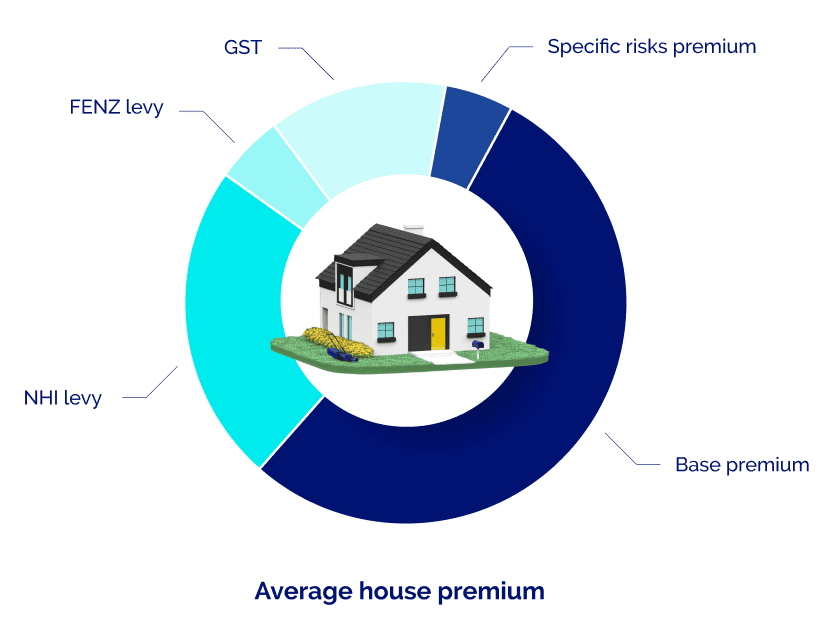

What makes up your house and landlord insurance premium?

Check out our breakdown of the insurance premium for an average suburban Hamilton home, so you can get an idea of where your money goes.

Base premium

This is used to cover claims and operational costs, such as employee salaries and our own insurance, known as reinsurance, which helps protect us and our customers during significant events and catastrophes.

Natural Hazards Insurance (NHI) levy

A mandatory government levy for residential house and landlord insurance holders. This is collected by insurers like Tower and passed on to the Natural Hazards Commission Toka Tū Ake (or NHC) to help rebuild or repair your home if it's damaged by a natural hazard event. Learn more about the NHI levy

Fire and Emergency New Zealand (FENZ) levy

This contributes to Fire and Emergency New Zealand, supporting fire and emergency services. Learn more about the Fire and Emergency New Zealand levy

Specific risks premium

In New Zealand, flooding and earthquakes can cause significant natural hazard events. Premiums are priced using RMS® Risk Models to assess these risks to your property and help pay claims for these events.

Tax (GST)

Your premium includes a 15% Goods and Services Tax (GST).

Risk-based pricing

We work closely with Risk Management Solution (RMS®) - a leading catastrophe modelling company, to understand the risks at your property, which then enables us to price your house and landlord insurance premiums.

This risk-based pricing method means your premium is calculated based on the likelihood of certain risks like earthquakes and floods, which varies by location, the magnitude of these risks, and the damage they subsequently cause to your individual house when they do happen.

Factors such as soil type, proximity to water bodies and fault lines, and elevation are considered. The age of your home, the material used to construct it, and the sum insured also influence your premium.

Reviewing everything at such a detailed level means flood and earthquake damage risk can vary from one address to another, even for properties on the same street. This is reflected in your premiums.

We review new data as it becomes available, and this can affect your premiums since these risks change over time.